Special Requirements from Customs All Over the World

2021-07-19

Different countries have different requirements and regulations on the import and export of goods. We must understand the details of each country's import and export so that there will be no problems at critical times.

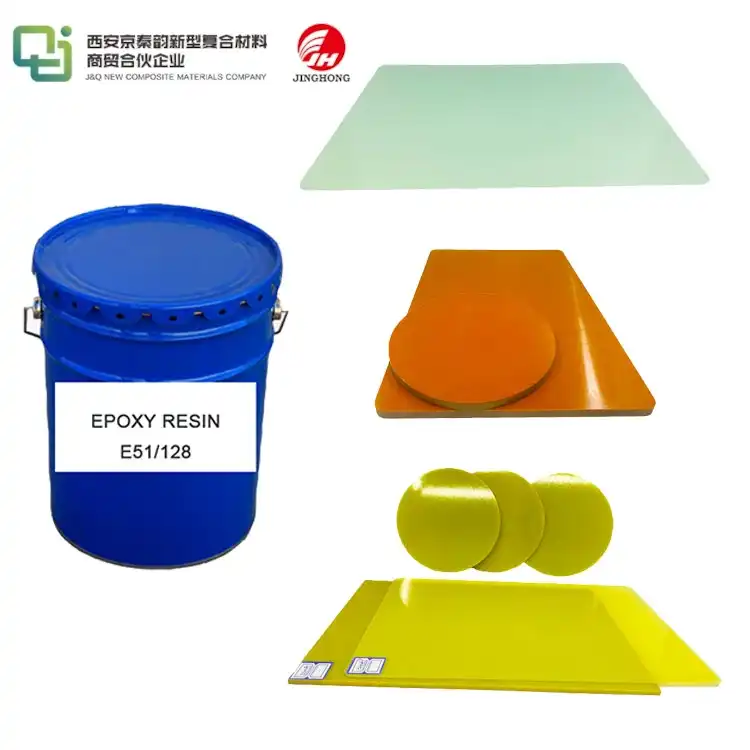

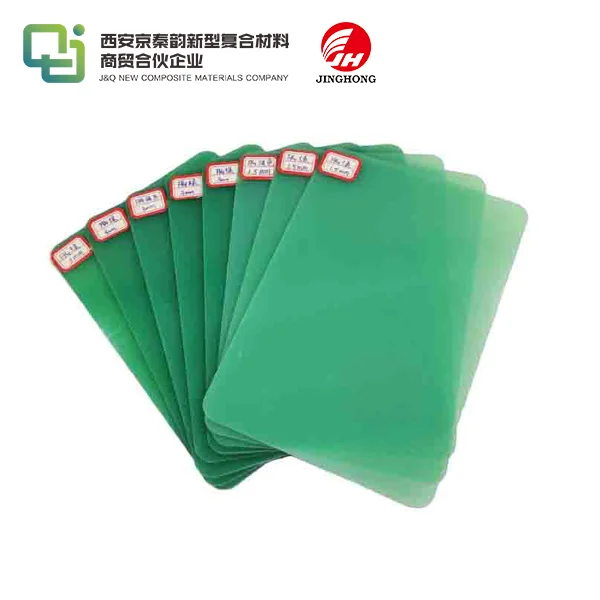

One of our greatest advantage is we have our own logistics company, so it can provide safe and fast service to you. What we are trying to do is providing our customers one-stop service from production to delivery. Also, we are the factory of FR4 sheet, 3240 epoxy plate, 3026 phenolic cotton board, and phenolic paper board and if the order is directly from us, it will have the priority to produce.

Countries that need to declare AMS

United States, Canada, Mexico, Philippines

(The U.S. does not need to declare the ISF regulations and must be provided to the U.S. Customs 48 hours before sailing, otherwise there will be a fine of USD5000, AMS fee of 25 USD/ticket, and 40 USD/ticket if modified). Since July 1, 2016, all goods imported into the Philippines must be declared AMS in advance. In addition to the original EBS in the Philippines, CIC will add an additional AMS surcharge. Goods to the Philippines are required to declare AMS in advance.

Countries that need to declare ENS

All member states of the European Union, ENS costs 25-35 USD/ticket

Countries where wooden packaging needs to be fumigated

Australia, United States, Canada, South Korea, Japan, Indonesia, Malaysia, Philippines, Israel, Brazil, Chile, Panama

Countries requiring certificate of origin

Cambodia, Canada, UAE, Qatar, Bahrain, Saudi Arabia, Egypt, Bangladesh, Sri Lanka

National customs regulations

Indonesia

Finally, the consignee must have the right to import and export goods, otherwise it will not be able to import customs clearance.

Saudi

All goods imported into Saudi Arabia must be shipped on pallets and the country of origin and mark must be printed on the packaging. And since February 25, 2009, all goods arriving at the port that violate the regulations and are not shipped on pallets will be fined separately, which will be borne by the customer.

Brazil

a. Only three originals of a full set of bills of lading are accepted. The amount of freight must be shown on the bill of lading (only US dollars or Euros can be used). "TOORDER" bills of lading are not accepted. The contact information (telephone, address) of the consignee must be displayed on the bill of lading.

b. The CNPJ number of the consignee must be displayed on the bill of lading (the consignee must be a registered company), and the consignee must be a company registered in the destination customs;

c. It is not possible to pay on collection, and it is not possible to collect more money at the port of destination. The wooden packaging must be fumigated, so the LCL quotation needs more attention.

Mexico

a. To declare the AMS bill of lading, the product code must be displayed, and the AMS information and packing list invoice must be provided;

b. Notify shows the third-party notifier, which is generally a freight forwarding company or CONSIGNEE's agent;

c. Show the real consignor and consignee;

d. The product name cannot display the general name, but the detailed product name should be displayed;

e. Number of pieces: It is required to display the detailed number of pieces, for example: There are 50 boxes of goods in 1PALLET;

f. The bill of lading must show the origin of the goods.

Chile

Chile does not accept telex bills of lading, and wooden packaging must be fumigated.

Panama

a. Telex bill of lading is not accepted, the wooden packaging must be fumigated, and packing list and invoice must be provided;

b. The goods transiting through the Colon Free Trade Zone and going to Panama must be stackable and can be operated by forklift, and the weight of a single piece cannot exceed 2000KGS.

Colombia

The bill of lading must show the freight amount (in US dollars or Euros).

India

Regardless of FOB or CIF conditions, regardless of whether the bill of lading is "TOORDER OF SHIPPER" (instruction bill of lading), regardless of whether the bill of lading is in your hand, the Indian side can not pay and is technically legal. In the import declaration BILL OFENTRY (import declaration manifest) and As long as the name of the Indian customer is displayed on the IGM (import cargo manifest), you have lost the cargo rights, regardless of whether the bill of lading is in your hand, so be sure to pay 100% in advance as much as possible.

Russia

a. The payment must be timely, or the two parties have a long-term cooperation, otherwise it is recommended to pay first! Or more than 75% must be paid in advance;

b. After the goods arrive at the port, the customer must be urged to pay and urge the customer to pick up the goods! Otherwise, after the goods arrive at the port, no one picks up the goods and the goods are hacked by the customs, or you have to pay a high fee and the customer can release the goods without bills through the relationship. Sometimes this market is justified and unclear;

c. In view of the procrastination of the Russians, you must remember that whether it is prepayment, delivery, or payment back, you must urge you.

Kenya

The Kenya Bureau of Standards (KEBS) began to implement the pre-export standard compliance verification program on September 29, 2015. Therefore, since 2005, PVOC has been adopted as a pre-shipment verification method. The products in the PVOC catalog must obtain compliance (CoC) before shipment. CoC is a mandatory customs clearance document in Kenya. Without this certificate, the goods will be refused entry after they arrive at the Kenyan port.

Egypt

a. Commodity Inspection Bureau implements pre-transit inspection and supervision work;

b. Regardless of whether the commodity inspection is required by law or not, the customer is required to provide a renewal voucher or receipt, a formal inspection authorization letter, packing list, invoice, and contract;

c. Go to the Commodity Inspection Bureau to handle the customs clearance form with the certificate of renewal (single) (the statutory commodity inspection can get the customs clearance form in advance), and then make an appointment with the commodity inspection staff of the Commodity Inspection Bureau to go to the warehouse to supervise the installation at a specific time. (To make an appointment a few days in advance, you need to consult with the local Commodity Inspection Bureau)

d. After the Commodity Inspection Bureau staff arrive at the warehouse, they will first take pictures of the empty containers, and then check the number of boxes for each shipment, check that one ticket is packed in one ticket, and take a picture of one ticket until it is fully loaded, and then go to the Commodity Inspection Bureau Change the customs clearance form before you can arrange the customs declaration;

e. Approximately 5 working days after customs clearance, go to the Commodity Inspection Bureau to obtain the port of destination customs clearance and pre-shipment inspection verification, and foreign customers can use this certificate to handle customs clearance at the port of destination;

f. For all goods exported to Egypt, the corresponding documents (certificate of origin and invoice) must be certified by the Egyptian embassy in China. The stamped documents and pre-shipment inspection and verification can be carried out at the destination port of Egypt for customs clearance and delivery. The embassy recognizes After customs declaration or after the export data is confirmed;

g. The Egyptian Embassy certification will take about 3-7 working days, and the pre-shipment inspection and verification will take about 5 working days. Other customs and commodity inspections can consult local officials. When talking about customers, market personnel must set aside their own safe time to operate accordingly.

Pakistan

Karachi Port Authority stipulates that imported paper bags of carbon powder, graphite powder, magnesium dioxide and other dyes must be palletized or properly packed, otherwise they will not be unloaded. In addition, Pakistan does not accept ships flying the flags of India, South Africa, Israel, South Korea and Taiwan.

Saudi Arabia

The Saudi government stipulates that all goods transported to Saudi Arabia are not allowed to transit through Aden.

United Arab Emirates

The health authorities of Dubai and Abu Dhabi ports stipulate that all imported food must indicate the expiration date and carry the health instructions on the ship, otherwise the Hong Kong side will not unload the goods.

Maldives

a. Without the permission of the Ministry of Internal Affairs, the import of various drugs, sulfuric acid, nitrate, dangerous animals, etc. is not allowed.

b. Without the permission of the Ministry of Foreign Affairs, it is not allowed to import alcoholic beverages, dogs, pigs or pork, statues, etc.

Canada

The Canadian government stipulates that for cargo to the east coast of the country, the best winter delivery is in Halifax and St. John's, because these two ports are not affected by freezing.

Argentina

Argentine law stipulates that the consignee must declare the loss of the bill of lading to the customs. After approval by the customs, the shipping company or its agent will issue another set of bills of lading, and at the same time submit a statement to the relevant agency that the original bill of lading is invalid.

Tanzania

The Tanzania Port Authority stipulates that all goods transported to Dar es Salaam port to Tanzania or transshipped to Zambia, Zaire, Rwanda, Burundi and other countries must be marked with a cross mark of different colors on a prominent position on the package for classification and classification. , Otherwise the ship will charge a cargo classification fee.

Djibouti

The port of Djibouti stipulates that for goods transshipped in this port, all documents and packaging marks should be clearly filled in the final destination port, such as WITH TRANSHIP-MENT TOHOOEIDAH, but it must be noted that the above content cannot be filled in the destination port of the bill of lading, but only Indicate it on the header or in other blank spaces of the bill of lading, otherwise the customs will treat it as Djibouti’s local goods, and the consignee must pay the import tax before releasing it.

Kenya

The Kenyan government stipulates that all exports to Kenya must be insured by Kenyan insurance companies. Do not accept CIF terms.

Cote d'Ivoire

a. The name of the goods listed in the bill of lading and manifest should be specific and detailed, and cannot be replaced by the type of goods. If the above regulations are not followed, the customs fines incurred by the carrier will be borne by the shipper;

b. For goods transiting through Abidjan to Mali, Burkina Faso and other landlocked countries, the bill of lading, shipping documents and cargo transportation package must be marked "Côte d’Ivoire transit" to be exempt from tax, otherwise additional tax will be imposed.

Nigeria

In order to prevent illegal merchants from arbitrating foreign exchange, the Nigerian Central Management Department stipulates that all imported goods must be inspected by the branch agency of the Swiss General Notary Bank to pass the inspection and obtain "CLEAN REPORTOF FINDINGS" before the consignee can clear the goods and pick up the goods.

Australia

The Australian Port Authority stipulates that when goods are imported in wooden boxes, the wood must be fumigated and the fumigation certificate will be sent to the consignee. If there is no wood fumigation certificate, the wooden box will be dismantled and burned, and the cost of packaging replacement shall be borne by the shipper.

New Zealand

The New Zealand Port Authority stipulates that the wooden structure of the container and the wooden packaging and dunnage wood in the container must undergo quarantine treatment before entering the country.

Fiji

Fiji Customs prohibits import of switchblade knives and old clothes.

Iran

Article 90 of the Iranian Tax Law stipulates that freight tax is levied at 50% of the freight for loading and exporting goods at Iranian ports, regardless of where the freight is paid. Imported goods are exempt from freight tax. The Port Authority of Jeddah and Dammam stipulates:

a. Goods passing through the second port must be palletized at the port of shipment, and containerized goods must be palletized first and then packed;

b. The contents of the cargo documents must be detailed.